Citi Adds Three New API Partners in Hong Kong

Administrator Senin, 30 Juli 2018 19:12 WIB

Citi cardholders can now offset online purchases using reward points with an even wider range of merchants across key spending categories

HONG KONG, CHINA - Media OutReach - 30 July 2018 - Citigroup Inc. (NYSE: C) -Citi today announced the addition of three new API (Application Programming Interface) partners as the bank continues its effort to promote the benefits of API usage and cross-industry collaboration with the aim of bringing banking and credit card services to more customer digital touchpoints.

Joining the Citi API ecosystem are household brands EGL Tours, Fortress, and Watsons, all of which will be integrating the Citi Pay with Points API with their e-commerce platforms, enabling Citi cardholders to offset online purchases using their reward points instantly after checkout.

This follows the successful introduction of the Citi Pay with Points service on HKTVmall in March. At the time of the launch, over 50% of Citi credit cardholders who shop on the HKTVmall platform had experienced the convenience of being able to pay for online purchases using reward points.

Lum Choong Yu, Head of Cards and Unsecured Lending at Citibank Hong Kong, said, "In 2017, we became the first bank in Hong Kong to launch an open API platform to give developers and consumer brands direct access to our APIs for building innovative solutions that benefit customers.

We are extremely encouraged by the strong participation from our partners and our mutual commitment to enhance our clients' digital experience. Through our ever growing list of API partners spanning different industries, we are moving closer to our ultimate goal of bringing banking services to where customers need them and when they need them."

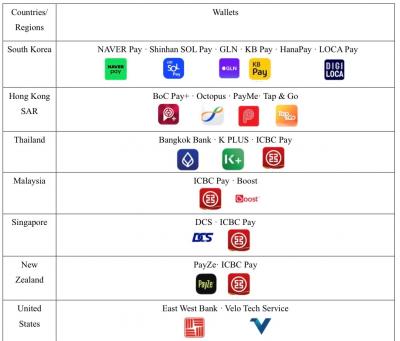

In addition to HKTVmall, previously-announced API partners by Citi Hong Kong include AIA Hong Kong, Octopus Cards Limited, Visa, and Zurich Hong Kong. The collaborations involve the use of Citi's Open API technology in various categories covering Cards, Customers, Money Movement, and Onboarding. The new services will be rolled out in phases in the coming year.

"A healthy banking open API ecosystem also requires industry-wide participation. We are fully supportive of the Hong Kong Monetary Authority (HKMA)'s initiative to promote wider adoption of open API in the banking sector and the recent release of the Open API Framework by the HKMA will further accelerate the implementation of this important milestone for the industry and reinforce Hong Kong's position as a leading fintech hub.

Being in a privileged position to be ahead of the four-phase implementation timeline outlined in the Framework, we are looking forward to sharing best practices with the industry and contributing in any way we can to help develop the fintech ecosystem in Hong Kong," said Lum. (MO).

Berita Terkait

Komentar

0 Komentar

Silakan Login untuk memberikan komentar.

FB Comments